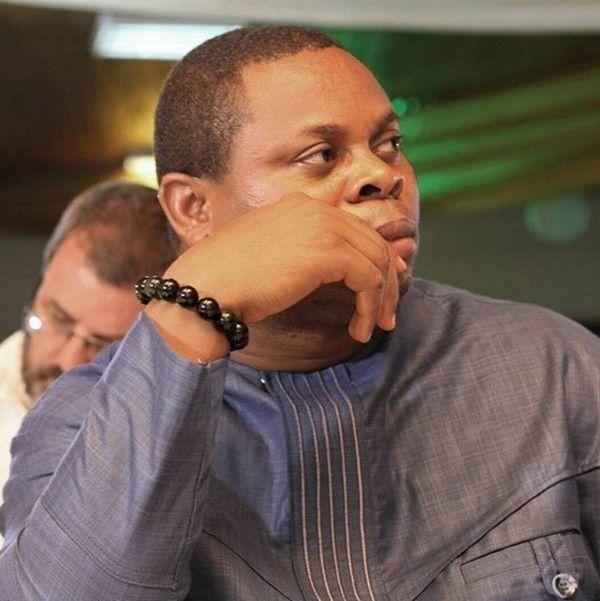

President of IMANI Africa, Franklin Cudjoe, has expressed worry over the Finance Minister, Dr. Amin Adam’s decision, to pump GH₵ 2.3 billion into the ailing National Investment Bank to resuscitate it.

According to him, he does not see the need for investing such a huge amount into a financial; institution that has not made profit since 2013.

Mr. Franklin Cudjoe made this assertion on his Facebook wall while reacting to the comments by the Finance Minister, Dr. Amin Adam, of government’s decision to inject money into the bank to see its revamp.

Mr. Cudjoe said, “That bank must just be killed. Politicians of all shades have pillaged the state bank and yet, successive governments keep fueling it with our taxes, especially during elections! The state’s loot-happy bank, has never recorded a $1 profit since 2013. Even in debt-distressed state, we continue this shackling! This is completely unacceptable!”

The National Investment Bank has faced a plethora of financial challenges with liabilities exceeding 2 billion as at October, 2023.

Following the challenges being faced by the Bank, the minority in Parliament had urged the government to undertake significant restructuring of the ailing NIB in order to prevent the Banks total collapse.

Although this was greatly disapproved by financial experts such as Dr. Atuahene, the minority caucus posited that, there was a viable alternative to the Bank’s woeful predicament.

Established through an act of parliament and regulated by the Bank of Ghana, the NIB bank currently has over 70% of the Bank’s portfolio made up of loans to the Ghanaian private sector who are yet to pay off the loans.

With the current economic challenges and banking crisis, analysts suggest the bank’s Non-Performing Loans (NPLs) to both government and the private sector could be higher and negatively affect its financial standings.

The Bank is experiencing turbulent waves following a switch from its primary duties as bank for local industries and companies to a universal Bank that focuses on development and commercial banking activities.

In his monthly economic update report on Friday, May 24, Dr. Amin Adam stated that, “The Bank of Ghana and the Minister of Finance have designed and would soon begin the implementation of a credible, comprehensive and cost-effective plan that seeks to address NIB’s challenges, adding that the cabinet has approved a plan for the restructuring and recapitalisation of the National Investment Bank (NIB)”.

Dr. Amin Adam said, “As part of the implementation of the PCPEG, the cabinet has approved the plan for restructuring and recapitalisation of the National Investment Bank (NIB). This will require an injection of about GH₵ 2.3 billion and this will be done over the next 12 months.”

He added that, “The first tranche of GH₵400 million is expected to be transferred to the National Investment Bank before the end of this month. This demonstrates our commitment to implementing the recapitalisation and restructuring programme of NIB. The plan also includes measures to strengthen the governance structure. The government has intervened in NIB in the past and so this time around, the capital intervention is going to be backed by governance reforms in NIB in order to assure us and the people of Ghana to their money that would be put into NIB would be managed well.”

In the view of Franklin Cudjoe, it is an absolute waste of resources to inject funds of this magnitude into a bank that has not made any tangible gains since 2013.

Source: Kobina Darlington/peacefmonline.com